Global Retirement Survey

Measuring retirement readiness and the steps workers can take to improve their financial path to retirement

Understanding Fidelity’s Retirement Readiness Score

To better understand retirement readiness of people around the world, we recently conducted a retirement survey that posed a comprehensive set of financial and behavioural questions to working people in the United Kingdom, Germany, Japan, Hong Kong, Canada and the United States.

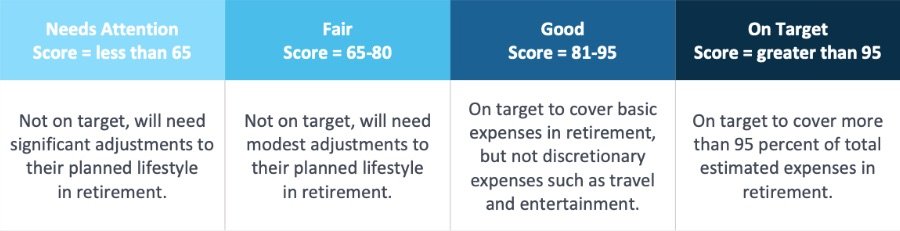

Based on the survey data and our retirement planning methodology, our analysis assigns each region a readiness score from zero to 150 - the Fidelity Retirement Readiness Score. This measures whether people in that region are on track to maintain their pre-retirement lifestyle in retirement. The higher the score, the better as described below:

Innovative measure assesses overall retirement readiness

Retirement readiness across the globe

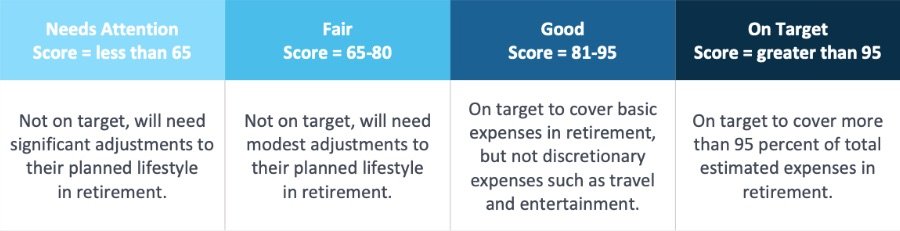

With median1 retirement readiness scores across the regions surveyed in the low 70s to low 80s, our research shows that there is an opportunity for most households surveyed to make improvements in order to sufficiently cover retirement expenses. In addition, survey responses indicate that people across all regions and age groups find the retirement planning process very complicated and many feel they don't know where to start. This presents a critical opportunity to not only educate workers on how best to plan for retirement, but also to make it easier for them to do so.

1The Retirement Readiness Scores are the median, or midpoint, score for the population surveyed in each region.

Fidelity’s median global Retirement Readiness Scores

Source: Fidelity Global Retirement Survey 2019. Visual represents the median retirement readiness score for each region and the distribution (%) of scores across the four categories for each region.

Factors impacting retirement readiness

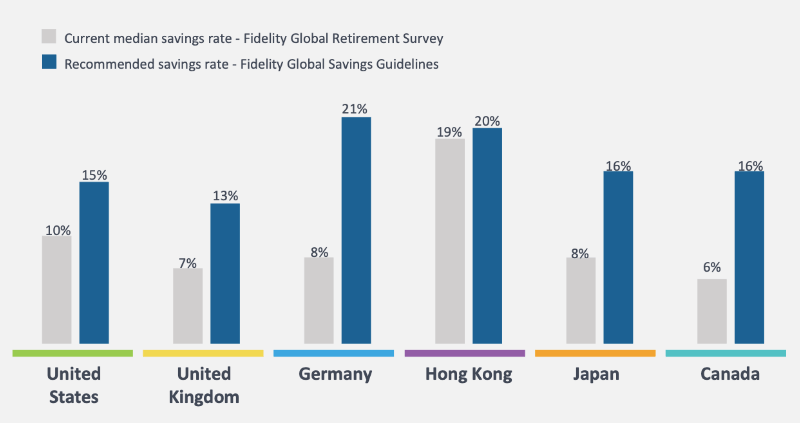

The largest hurdle to retirement readiness is insufficient savings rates. In separate research, our Global Retirement Savings Guidelines recommend a total savings rate spanning between at least 13% and 21% of annual income (before tax) each year depending on the region. Survey responses show that many workers are missing this mark, some by a significant margin.

Global yearly savings rates

Source: Recommended savings rate - Fidelity Global Retirement Savings Guidelines; Current median savings rate - Fidelity Global Retirement Survey 2019.

How retirement savings are invested also has an impact on retirement readiness. Having a diversified portfolio not only helps to guard against investment risk, it can also lead to asset growth, helping workers achieve their retirement saving goals. Our research finds that workers across the regions are generally underweight in equities, with the median deviation from age appropriate equity allocation varying from an underweight of 35% in Hong Kong to an underweight of 65% in Germany.

Expectations of retirement age and health are additional challenges. In every region surveyed, workers anticipate retiring early. For younger workers, who currently have a limited view of what their financial position might be at retirement, this may be an optimistic hope rather than a firm plan. Many people also fail to consider the potential impact of health concerns, which may force an earlier than planned retirement and require a higher savings rate.

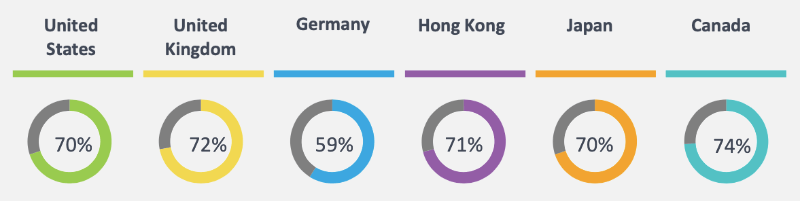

At Fidelity, we encourage people to save for the long term and all that they may face along the way; that may include an early retirement or perhaps working into their 70’s and beyond. In fact, nearly three-quarters of workers in all regions surveyed either plan to work, by choice or necessity, at least part time in retirement or are “unsure” regarding their plans to work in retirement.

Plan to work at least part time in retirement or unsure

Source: Fidelity Global Retirement Survey 2019.

Helping employees with retirement readiness

There is a clear need for active retirement planning and employers, as part of their workplace investing offering, can play a key role in helping employees improve their financial position for retirement. A significant number of workers reported that retirement planning is too complicated to do themselves and very few (less than 25%) have a formal written plan.

For employers, helping employees understand their retirement savings goals, as well as steps they can take to reach those goals, may assist in bolstering retirement readiness across their workforce.

Key pre-retirement steps

Source: Fidelity Global Retirement Survey 2019

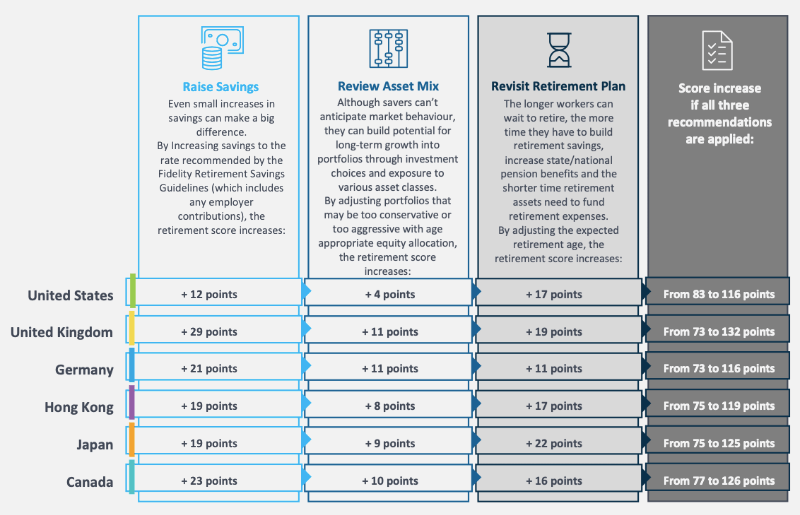

Analysis of the survey results shows that taking these actions would increase the overall median retirement readiness scores across all regions. While we recognise that not all these steps are possible or appropriate for everyone, those who take as many of them as possible may benefit significantly.

Moving forward

Much more can be done to improve the state of retirement readiness across the world. Although not all workers will be able to land in the coveted ‘On Target’ zone, those who understand the importance of setting appropriate retirement goals and who learn what actions to take to reach them will greatly improve their prospects to meet their total estimated retirement expenses.

We believe that by working with employers, we can help to provide the education and guidance employees need to prepare themselves properly for retirement. We have developed a globally-consistent set of retirement savings guidelines to help people get started on their retirement savings journey. Based on four interconnected metrics, the guidelines can help employees plan their journey and explore the impact of actions like saving more, retiring later or making lifestyle adjustments to their retirement goals.

The road to retirement readiness is long but by encouraging your employees to start saving as early as possible and providing them with the resources necessary to make informed financial decisions, together we can create better outcomes.

Global Retirement Survey Report

Global

Germany

Japan

Things to keep in mind

This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action.

Investment involves risks. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

About the Fidelity Global Retirement Survey

The survey population consisted of respondents with the following qualifying conditions: individuals aged 20-75 years old; working full-time or part-time or have spouse working full-time or part-time; not retired; expecting to retire someday; with or without retirement savings; the main financial decision maker or equal joint main financial decision maker in the household; a minimum household income of United States: $20,000 annually; United Kingdom: £10,000 annually; Germany: €20,000 annually; Hong Kong: HK$15,000 monthly; Japan: ¥3,000,000 annually; Canada: CA$10,000 annually.

The research and analysis were completed for the United Kingdom, United States, Canada, Germany, Hong Kong and Japan. Data collection was completed in partnership with Ipsos, a global market and opinion research specialist, who collected and collated data for each region in September 2019.

About the Fidelity Retirement Readiness Score and pre-retirement steps

The Retirement Readiness Score offers a simple, intuitive, standardised (consistent and comparable) measure of the degree to which one is financially on track for retirement, as well as a means of evaluating the potential improvement associated with improved retirement behaviours.

The goal is to gain a better understanding of where workers across the world are today when it comes to retirement readiness and how this readiness varies within a given region. Our analysis looks at retirement savings and spending, not only to provide a more comprehensive picture of the state of retirement readiness, but also to offer people specific steps that can be taken to improve their likelihood of living the lifestyle they expect in retirement.

The score is based on a 150-point scale where zero indicates a person is projected to be unable to meet any of the retirement expenses estimated to be necessary to maintain one’s pre-retirement lifestyle in retirement and 150 means a person is projected to be able to meet 150% of those retirement expenses.

The Fidelity Retirement Readiness Score is calculated using Fidelity’s proprietary methodology which consists of region-specific modelling assumptions that are applied to survey data. More specifically, the methodology looks at age, marital status, gender, asset allocation, savings rate, accumulated savings, other income sources, retirement age, and life expectancy to estimate income needs in retirement. The estimated income needs, determined through Fidelity’s evaluation of national income and expenditure data, taxation and pension data are then compared to projected retirement savings balances and other income sources to determine the extent of retirement readiness.

The key pre-retirement steps - raise savings, review asset mix, revisit retirement plan - applied individually, or in combination, will have a positive impact on retirement readiness. The impact of increasing savings and adopting an age-appropriate asset mix will be greater for those further from retirement due to the longer remaining accumulation period. Retirement readiness will benefit to a greater extent when the impact of these positive actions can play out over a longer period. Improvements can vary significantly based on how far one’s current behaviours/plans deviate from the targets associated with each step and how much time one has between one’s current age and planned retirement for the potential benefits to manifest themselves. The impact of the steps can vary from country to country depending on the current and projected savings amounts, asset allocation and estimated retirement ages reported by survey respondents.

About Fidelity’s Global Retirement Savings Guidelines

The Fidelity Retirement Saving Guidelines, released globally in November 2018, provided a set of general retirement saving/spending guidelines (rules of thumb) for required savings rate, age-based savings milestones, required income replacement, and possible sustainable withdrawal rates.

The Fidelity Retirement Savings Guidelines refer to personal and workplace savings amounts only and exclude any state/government pension support. To generate the guidelines the framework makes simplifying assumptions about a variety of factors, including retirement age, retirement horizon, wage growth, investment returns, and asset allocation. The base case used to generate the guidelines assumes a hypothetical 25-year-old with no current savings, and no private defined benefit (DB) pension income or other private lifetime income sources. All calculations and outputs are expressed in pre-tax terms. Along the way, and particularly as people get closer to retirement, it’s always a good idea to work with a financial advisor to create a retirement income plan based on your specific income needs and personal circumstances.

The 4 key metrics are calculated based on a base case with a set of region-specific assumption and they are for reference only.

- Yearly savings rate: The suggested annual rate of (pre-tax) savings over a full working lifetime.

- Savings milestones: Age-based savings targets expressed as multiples of current income.

- Income replacement rate: The percentage of pre-retirement income that an individual/household should target to replace annually from their personal savings (including workplace savings) in retirement in order to maintain pre-retirement lifestyle.

- Possible sustainable withdrawal rate: The real (inflation-adjusted), annual withdrawal amount expressed as a percentage of the initial (at retirement) asset balance.

For more information on the Fidelity Global Retirement Savings Guidelines please see the Whitepaper.

Fidelity refers to one or both of Fidelity International and Fidelity Investments. Fidelity International and Fidelity Investments are separate companies that operate in different jurisdictions through their subsidiaries and affiliates. All trademarks are the property of their respective owners.